Without marketing, you have no business, no community, and no longevity. FinTech companies face challenges that are unlike most other industries, particularly since the product is relatively new and different. FinTech brands must be as creative in their marketing efforts as they are in creating innovative services. This means financial startups' main areas of concern should be based on educating and building rapport with consumers.

With FinTech companies, educating and connecting with the audience is done through digital marketing that is powerful and digestible. Companies don’t want to intimidate those unfamiliar with their product, so their branding needs to be easy and not “too techy”. For startups in the financial sector, digital marketing can look like a mountain to climb. However, the trip doesn’t have to be so complex with the right strategic solutions.

After reading this section, you will understand some of the top methods for financial companies when approaching a digital marketing campaign. More importantly, you will understand why these methods are effective in a highly competitive market:

Branding

The main priority for financial companies, especially new ones, is getting the audience in tune with complex concepts. This can be done in several ways, but the common starting point is by understandably framing the product. Beyond that, companies will want to create hype and ultimately FOMO (Fear Of Missing Out) around the product. For example, making investment decisions is based on complex variables. Over 60% of adults are intimidated by investing, a trend that is only becoming more prevalent with each generation. FinTech mobile apps aim to assist those unfamiliar through analytics and AI-generated investment guidance. By using the product, customers will be able to get ahead in planning for their future while being involved in the process.

In this example, we see that positioning your brand as the latest way to get personalized investment advice based on easy-to-understand data while acknowledging consumers' intimidation generates interest. It should also be noted that honesty in your company messaging is the best way to market, especially as a tech company. One of the top reasons tech companies lose business is hyperbole, which means that transparency in the company's vision and capabilities is crucial.

Branding is not simply a logo, colours, or font that represents the company. This is where some businesses stop and as a result have branding but no brand. True branding is developing emotional attachment behind the materialized elements of your brand. You will buy certain clothing because of how it makes you feel, certain product labels because you trust them, or support businesses that support other causes. In a competitive market, find your niche and use it to be unique (which you’ll see examples of further in).

Digital content marketing

Again, FinTech firms need to educate the audience on what's relevant and upcoming, which is where digital content tools such as videos, blogs, interviews, speakers, etc., are most valuable. No matter what stage your company is at, this will require consistent content that is engaging and informative. The average consumer attention span is 8 seconds which is generous if you observe how people scroll on social media. Essentially, the general rule of thumb with content is the instant hook/incentive which becomes a transaction in itself with the consumer.

No matter what it is, keep it simple. Crypto trading platform Coinbase uses “learn and earn” where users can receive cryptocurrency in exchange for completing lessons and quizzes. This is a perfect example of what content marketing should look like. The goal is to generate leads, conversions, and build awareness of your brand's initiative. If implemented correctly, you’ll find content marketing scalable and great for globally expanding your audience reach. Another good example would be to take a look at FinTech company Current, scroll at least three swipes through their website and you’ll see a great example of generating appeal in today's market.

Create a mobile experience

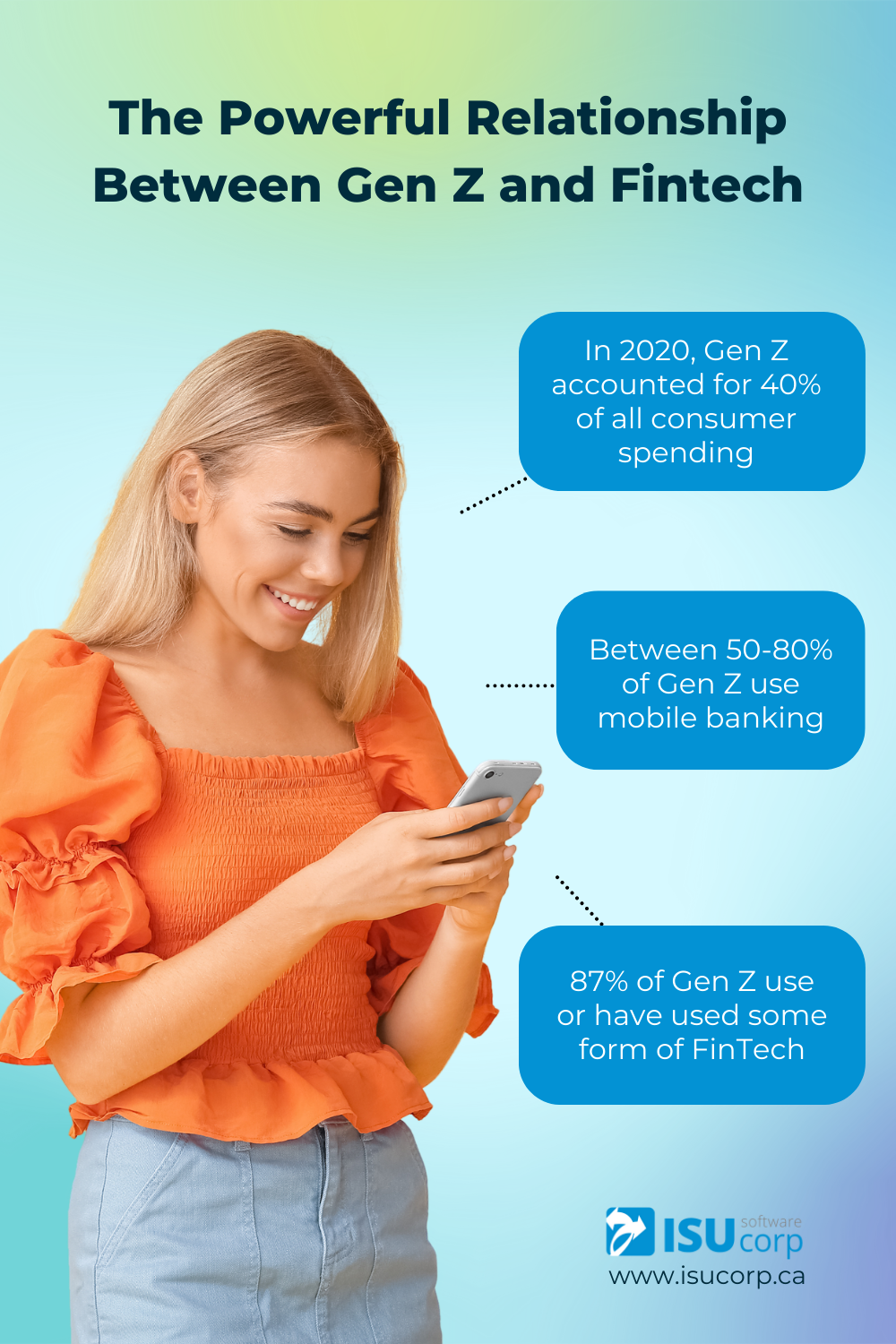

This is pivotal to compete in 2022. Remember, FinTechs are up against traditional banking systems and are fully digital which means the best place they can beat them is in a mobile experience. Branding and marketing are great for getting the customer, but retaining that business comes from differentiation. FinTechs who are the most disruptive are the ones who function entirely online (otherwise known as neobanks).

Online banking is continuously growing; in the United States alone, there are over 23 million people who use only online banking services. The uprising of neobanks is enhancing this vision of a fully digitized consumer market. The top neobanks in North America (ranked in order) are Chime, Current, Aspiration, and Varo. While each has its unique features, the number one factor that makes them the best is their mobile experience.

Get active on social media

Over 30% of American consumers have at least one FinTech app on their mobile device and spend upwards of 5 hours each day on that device. This screams one thing for digital marketers: OPPORTUNITY. This is prime real estate for advertising in-app, especially for brands that operate solely online or that are trying to make the transition from traditional banking to modern FinTech.

Specifically, brands want to keep up with current trends and initiatives while zeroing in on their target market. A great example of this is financial company Ellevest whose slogan is “by women, for women”. They tackle the imbalance of women's involvement in investing and offer personal finance coaching along with spending incentives. Ellevest ran a campaign called ‘’invest like a woman” which was aimed at inspiring women to take control of financial responsibilities that are traditionally built for men.

You can see here that brands that add their touch are the ones who do the best. There is a level of authenticity that makes companies distinguishable, and to connect with the audience and take advantage of that, social media will be the best outlet.

The takeaway

The online sector is where businesses are finding opportunities for longevity. These opportunities, however, only present themselves with well-thought-out execution. This is especially true for financial institutions since this business is built on trust and understanding. Remember, it’s not that you do it, it’s how you do it, and in the case of marketing, how you present your brand will factor into its lifespan.

Written By Ben Brown

—

ISU Corp is an award-winning software development company, with over 17 years of experience in multiple industries, providing cost-effective custom software development, technology management, and IT outsourcing.

Our unique owners’ mindset reduces development costs and fast-tracks timelines. We help craft the specifications of your project based on your company's needs, to produce the best ROI. Find out why startups, all the way to fortune 500 companies like General Electric, Heinz, and many others have trusted us with their projects. Contact us here.